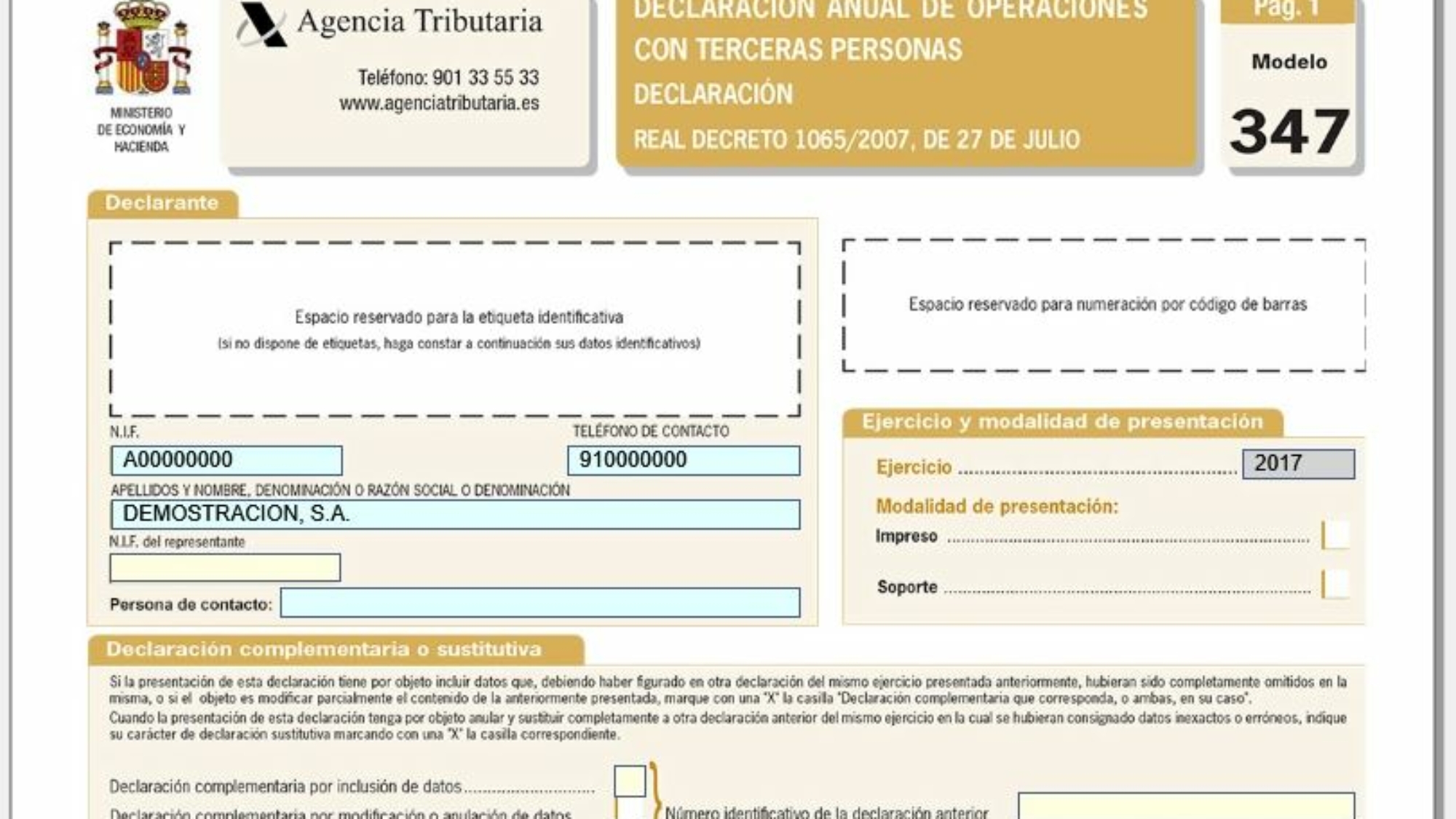

How will you know, The Tax Agency is developing the final regulations for compliance with the New Anti-Fraud Law, 11/2021, of 9 of July, of prevention measures and fight against tax fraud

https://www.boe.es/buscar/doc.php?id=BOE-A-2021-11473

They have already been published through the Royal Decree 1007/2023, of 5 December 2023, the requirements of computerized billing systems for entrepreneurs and professionals.

https://www.boe.es/diario_boe/txt.php?id=BOE-A-2023-24840

And now we are waiting for the publication of the Ministerial Order of technical and functional specifications of computer billing systems

From the date of said publication of said Ministerial Order, Billing software developers will have a deadline of 9 months to adapt their systems to the new regulations.

And the 1 July 2025, obligatory, All billing software must work in accordance with the new regulations.

And all corporate and self-employed businesses will be obliged to comply with it..

This ends the possibility of making invoices written on paper or using Word or Excel..

They will only be legal, in Spain, invoices issued through computer systems adapted to the new regulations.

The regulations of the Tax Agency allow 2 modalities:

– No, actually

In this mode you have to format the invoice, sign it with a digital certificate, keep it for several years, make backups and make sure it cannot be altered (nor delete, nor alter).

And you have to create an event registration system (that you can request from the Treasury at any time).

In this event log, all accesses and changes that have occurred in the invoice system must be noted..

And you must have a system like Veri*Factu to send invoices when requested by the Treasury..

This entire process to guarantee traceability, integrity, immutability, conservation, accessibility and legibility of invoices is very difficult to meet.

And non-compliance implies strong sanctions..

– To be true

In this mode, it is enough to format each invoice, chain it using a hash and send it when it is issued.

You are also required to print invoices including a QR code that will be generated through a certain process..

And with it, since all invoices are held by the Treasury, the rest of the obligations are considered fulfilled.

Therefore there is no danger of sanctions.

It is the modality recommended by the Treasury.

We will only offer the Veri*Factu modality.

I leave you the links to the latest online presentation of the Tax Agency, which I attended, of the 14 February.

The first part is theoretical and tells the regulations:

https://www.agenciatributaria.es/static_files/AEAT_Desarrolladores/EEDD/IVA/VERI-FACTU/20240211SeminVerifactEEDD-ONIF.pdf

The second is more practical and tells how it will work:

https://www.agenciatributaria.es/static_files/AEAT_Desarrolladores/EEDD/IVA/VERI-FACTU/20240211SeminVerifactEEDD-DIT.pdf